With the amount of technology in our lives today, the hot new trend among thieves is in cyberspace. From hacking to social engineering, thieves are making their money by scamming others out of their cash.

How do you protect yourself and your assets? By following some common practices to ensure if something does happen, you aren’t completely ruined. Avoid cyber scams with these quick tips!

– Stop using debit cards. Debit cards don’t offer the same fraud protection that credit cards offer. A debit card is a direct link to your checking account. A hijacked card can be devastating, causing checks to bounce, automatic bill payments to fail, etc. Banks are now offering credit cards to those who qualify to help protect their customer’s cash and avoid a mountain of hassle and heartache if something does get compromised.

As a side note, avoid any ATM terminals that are out of sight in gas stations and convenience stores. They are prime targets for scammers that use “skimming” devices to copy your card’s info when you insert it.

– Don’t “put all of your eggs in one basket.” Maybe you have a checking account and a savings account. Are they with the same bank? If so, maybe you should consider moving one of those accounts to another bank in case one is breached. This way, all of your resources are not in danger. The best thing is to have two accounts with two different banks, each one with at least enough to cover 1 full month of bills, including food and gas.

This does create more work to manage but if something ever does happen, you will be glad you took the extra steps to protect yourself.

– Use strong passwords and two-factor authentication. Use two-factor authentication for any banking or credit card site that offers it! It will send you a text message with a one-time use password to log into your account even after you enter your password. This makes it much more difficult for a criminal to brute force into your account.

– Avoid using cell phone charging stations. These stations are starting to pop up more than ever, especially at business expos, sporting events and festivals. These devices can dump the information from your cell phone while charging! This attack method even has a cool name: Juice Jacking!

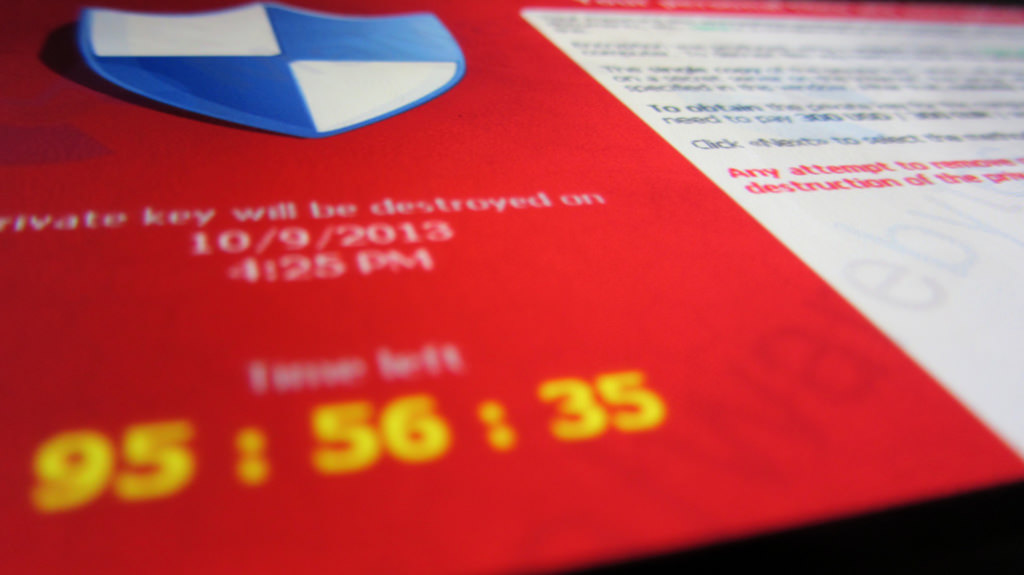

– Apps (desktop or mobile) that ask for credit card information outside of the normal app store. Chances are this is a scam, especially if it is holding your PC or data hostage unless you pay. Examples are popups that say “You have a virus, please deposit $10…” or “I’ve encrypted all of your files and I’ll unlock them for a price.”

If you do shop online, ensure the site you are at is a reputable company (Amazon.com, JCPenny, etc.…) and that you are using a credit card.

– Don’t be tricked into giving up your information. Any time you receive an unexpected phone call or email requesting account information or payment, do not give out your information. Hang up or hit delete and call your financial institution directly. You can find their information on your invoices or account statements.

Also, do not click any links to “tracking updates” from companies. Many schemes involve emails posing as UPS, FedEx and the like stating that “a package is on the way”. Clicking this link will open a door for a hacker to get into your computer and access anything you have stored there. Be safe, call the company directly and provide the tracking number in the email if you really are expecting something.